A simple and cost-effective way to access credit in the Philippines, with global acceptance and clear rules.

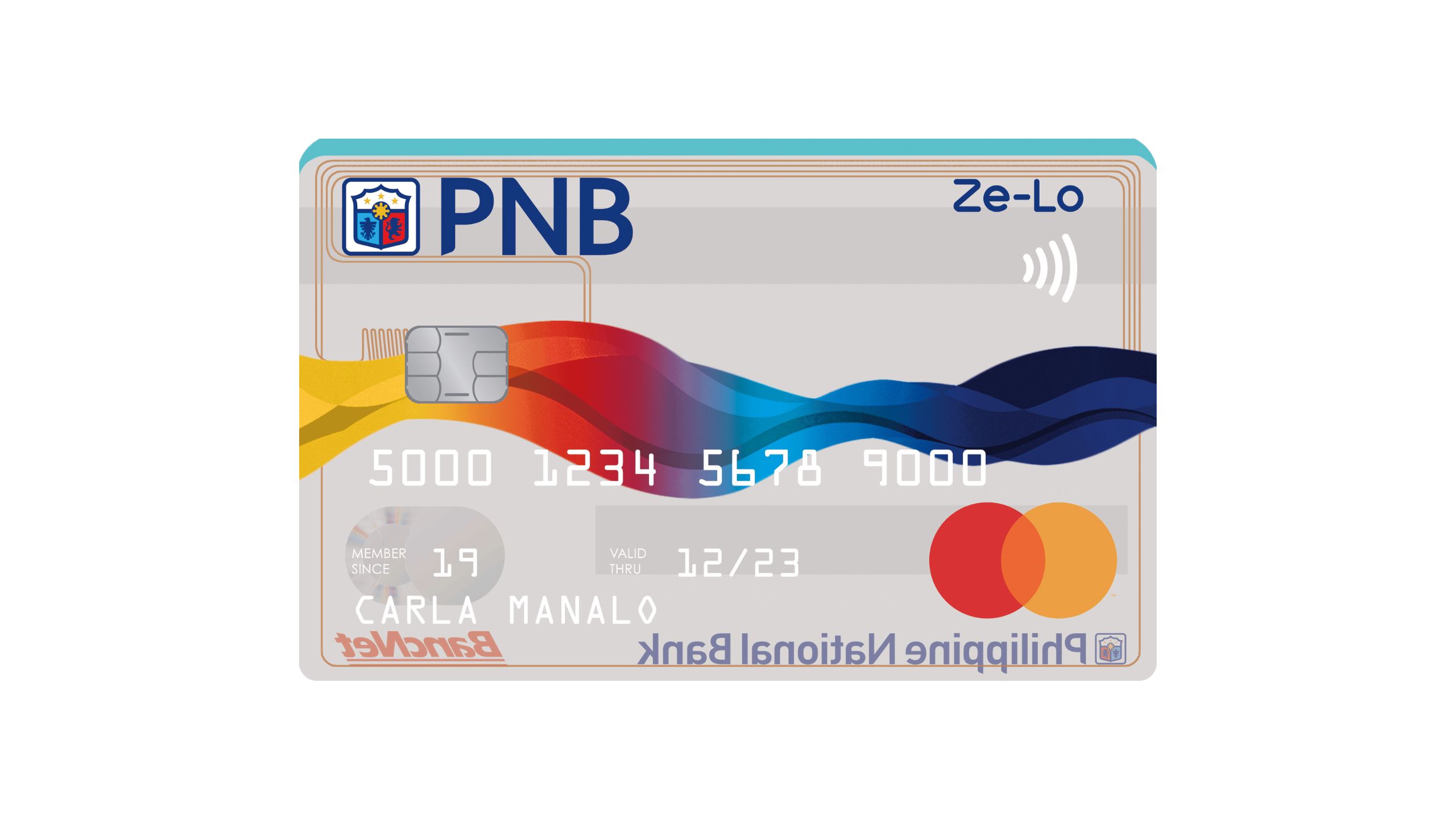

PNB Ze-Lo Mastercard could be the ideal card for your routine.

We recommend it for anyone who wants everyday convenience, no annual fee, and more predictability on the statement from the very first use.

Before applying, see why the PNB Ze-Lo Mastercard appeals to people looking for simplicity and savings.

You will remain in the same website

How the PNB Ze-Lo Mastercard Changed Ana’s Financial Routine

Ana always tried to keep her finances organized, but hidden fees and unexpected charges made budgeting stressful every month. She wanted a credit card she could actually trust.

After researching her options, she discovered the PNB Ze-Lo Mastercard. At first, she was cautious, unsure if a card with no annual fee could really work for her needs.

As she started using it, Ana noticed the difference. No penalties for simple mistakes, clear statements, and worldwide Mastercard acceptance gave her confidence and peace of mind.

With time, the card became part of her daily routine. She tracked expenses better, avoided surprises, and felt more in control of her financial decisions.

What began as a simple choice turned into a smarter way to manage money. And you? Sometimes, choosing the right card is the first step toward financial calm.

Is the PNB Ze-Lo Mastercard Worth Choosing?

The PNB Ze-Lo Mastercard stands out for promising a simple experience, with more predictable costs and an everyday focus on saving money.

In the Philippines, many cards offer perks, but some hide fees and conditions that only show up later—when the statement arrives and becomes frustrating.

That’s why comparing strengths and limitations is the safest way to see whether this card matches your financial profile.

Below, you’ll find clearly explained pros and cons to help you decide with confidence and avoid regret when applying.

Pros of the PNB Ze-Lo Mastercard

- ₱0 annual fee forever: You can keep the card active with no fixed yearly cost, reducing budget pressure and making it easy to use as a primary or backup card.

- No late payment penalty: Even though paying on time is best, not having this penalty reduces the impact of small setbacks and avoids punitive charges.

- No overlimit fee: If you go over the limit due to distraction or stacked installments, you won’t get an extra “just for that” charge, keeping the statement more predictable.

- Global Mastercard acceptance: Works well for online and in-store purchases, giving you more freedom to pay in different places—including during travel.

- Tap-to-pay and EMV chip: Contactless plus EMV chip brings faster checkout and stronger protection against common in-store fraud.

- Clearer costs for people who want simplicity: Ze-Lo has a straightforward approach with fewer rules, which helps beginners use credit more consciously.

Cons of the PNB Ze-Lo Mastercard

- Revolving interest can add up: A 2.5% monthly rate can become expensive if you don’t pay the full statement, so discipline matters to avoid debt.

- Starting limit isn’t guaranteed: The bank sets the limit case by case, so it may start lower—especially for people still building credit history.

- Fees for specific services may still apply: Even without annual fees and certain penalties, costs like cash advances and replacement cards can appear if you use those services.

- Less focus on rewards and premium perks: If you want strong miles, lounge access, or big rewards programs, Ze-Lo is usually more basic and functional.

Conclusion

The PNB Ze-Lo Mastercard is a solid option for anyone who wants a simple card with fewer common fees and a more predictable financial routine.

It fits well for people who prioritize savings and control—especially if you pay on time and use credit strategically.

On the other hand, those seeking robust rewards or a high starting limit may miss premium features.

In the end, the best choice is the one that fits your spending style—while keeping peace of mind, organization, and security in every purchase.

Yes, the card is promoted with a permanent ₱0 annual fee, meaning there is no standard yearly charge. Still, it’s important to follow bank communications for any future contractual changes. Want to better understand how the fee waiver works? Read the full article and see all the details.

Even without an annual fee, charges may apply for specific services, including interest on unpaid balances, cash advances, and issuing a replacement card. These fees depend on usage and the current contract terms. Discover all fees explained in a simple way by accessing the full article.

The initial limit is set after an individual credit assessment. Paying your statement on time, using the card regularly, and maintaining a good credit history help increase your limit gradually. See in the article how to use the card strategically to improve your limit.

It’s usually ideal for people who want simplicity, fewer fees, and control. Those looking for advanced rewards or premium benefits may prefer other available options. Want to know if this card fits you? Access the article and compare scenarios in more depth.

PNB Ze-Lo Mastercard: The Simple Card That Makes Your Daily Life Lighter

If you want a card that doesn’t complicate your life, the PNB Ze-Lo Mastercard stands out as a practical choice. It’s designed for people who value clear costs and an organized routine, without paying just to keep the card active. With Mastercard acceptance, you can shop online, at the grocery store, and while traveling with the same peace of mind—without relying on cash.

The real advantage is the sense of control: when the rules are simple, it’s easier to use credit consciously throughout the month. With no annual fee, you can test, learn, and adjust habits without the pressure of “needing to use it” just to offset a fee. And since the credit limit is set by the bank, you can plan spending, track your statement, and avoid excess with more calm.

In everyday use, Ze-Lo shines when you want convenience: tap-to-pay speeds up checkout and reduces friction. With every purchase, you notice that predictability is also a benefit—it protects your budget from unpleasant surprises. For people new to credit, this makes it easier to build history with more confidence, consistency, and healthy habits.

The best card isn’t the one packed with promises, but the one that fits your style and keeps you in control. If you want simplicity, broad acceptance, and a drama-free experience, the PNB Ze-Lo can be a smart next step. Explore the details, compare scenarios, and see how it can make your planning lighter, safer, and more comfortable starting today.