The card that helps you save money daily and during international trips.

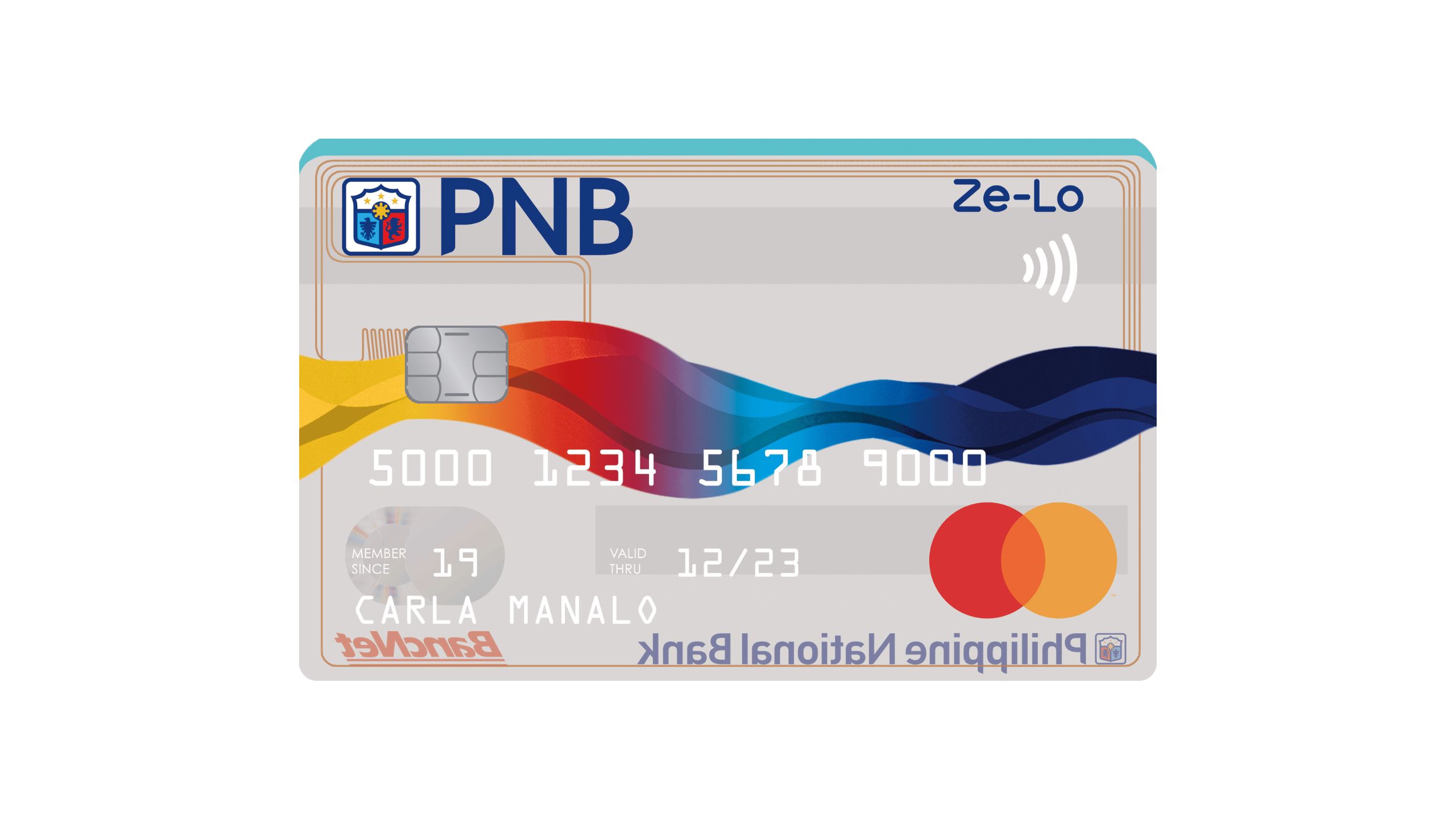

Cartão de Crédito cartão de crédito PNB Ze-Lo Mastercard is a practical option for anyone seeking a functional, simple card that fits easily into daily life.

It was designed for everyday use, with a straightforward proposal and no excessive rules, helping keep your budget more organized.

In addition, Mastercard acceptance expands purchasing options, both in physical stores and secure online payments.

In this guide, you will see benefits, possible fees, eligibility, and a direct step by step process to apply without complicating your planning.

| Category | Details |

| Initial credit limit | Not specified. |

| Annual fee | ₱0 |

| Interest rate | 2.5% |

Discover the PNB Ze-Lo Mastercard Credit Card: zero late fee, zero overlimit fee, and low interest for daily purchases

Cartão de Crédito cartão de crédito PNB Ze-Lo Mastercard delivers practicality for daily purchases, with a simple proposal that is easy to understand.

It is issued by Philippine National Bank, PNB, a traditional institution in the Philippines with long standing operations and nationwide presence.

Its credibility comes from the bank’s history, its customer base, and security standards, including chip technology and antifraud protection.

Focused on predictability, Ze-Lo prioritizes clear costs and easy use, helping you maintain control and peace of mind consistently.

Main benefits of the PNB Ze-Lo Mastercard Credit Card

Cartão de Crédito cartão de crédito PNB Ze-Lo Mastercard stands out by combining savings, simplicity, and practicality for those who want hassle free credit.

When you understand the benefits, it becomes easier to decide confidently and enjoy daily use without surprises on your statement.

₱0 annual fee forever

Starting with a card that has no annual fee helps you experience credit with less pressure and more financial freedom.

This makes usage lighter, since you only pay for what you spend, without fixed costs just for keeping the card active.

With Cartão de Crédito cartão de crédito PNB Ze-Lo Mastercard, this approach reinforces practicality for those who value predictability.

As a result, you can focus on purchase control and monthly planning without negotiating fee waivers every year.

No late payment fee

Knowing there is no late payment fee reduces the fear of missing a due date, especially during busy months.

Even so, paying on time remains ideal to keep your credit healthy and avoid interest on revolving balances.

This benefit works like a safety net, bringing peace of mind when unexpected situations happen.

With organization and reminders, you can use the card more confidently without pressure from punitive fees.

No overlimit fee

Going over the limit can happen due to distraction or installment purchases, so avoiding this fee brings immediate relief.

This also helps keep the budget under control, since no unexpected extra charge appears on the statement.

Even without the fee, it is worth monitoring available credit to avoid affecting important future purchases.

With discipline, you use the card strategically and maintain a sense of financial stability.

Global Mastercard acceptance for online and in store purchases

Having the Mastercard brand expands your options, whether in neighborhood shops or international online stores.

It makes subscriptions, apps, and digital purchases easier, while also working well for traditional in store payments.

Global acceptance also improves travel experiences, reducing declines and expanding payment alternatives.

With more places accepting it, you can choose where to buy based on value, without relying on one method.

Contactless payments with EMV chip

Tap to pay makes checkout faster, ideal for busy routines, groceries, and small daily expenses.

The EMV chip adds security layers, helping reduce common fraud in in person transactions.

It also avoids unnecessary contact with terminals, bringing more convenience in crowded environments.

By combining speed and protection, the card becomes more pleasant to use without sacrificing important safeguards.

Spending control with monthly statement and bank defined credit limit

The monthly statement helps identify spending patterns and understand where adjustments are possible without stress.

Since the limit is defined by the bank, you get a clear reference to guide spending responsibly.

Tracking purchases and dates also improves planning, reducing surprises and the risk of delays.

With this control, the card becomes an organization tool rather than a source of concern.

Installment options and PNB partner promotions

Promotions and installments with partners can make larger purchases more manageable without straining the entire budget at once.

These conditions usually appear in specific campaigns, so it is worth watching bank channels and announcements.

When used strategically, they help balance needs and comfort while keeping cash flow healthy.

The key is comparing offers, reading rules, and financing only what truly makes sense for your routine.

Simple and predictable card, ideal for daily use and first time users

A simple card is often the best start because you learn to use credit without getting lost in complicated rules.

Predictability reduces anxiety, keeping the focus on purchases, dates, and planning with fewer fee traps.

Cartão de Crédito cartão de crédito PNB Ze-Lo Mastercard fits this profile well, especially for those seeking practicality from the first use.

With good habits, it becomes an ally for building history, organizing expenses, and shopping calmly throughout the month.

Eligibility requirements to apply for the PNB Ze-Lo Mastercard Credit Card

Before applying, confirm that you meet the basic criteria required by PNB.

- Meet the eligible age according to bank rules, usually between 21 and 65 years.

- Provide proof of income and a stable payment source, subject to credit analysis.

- Submit valid identification documents and proof of residence when requested.

- Have active contact details and complete information on the application form.

Meeting these requirements increases approval chances and makes the process smoother and faster.

Step by step guide to apply for the PNB Ze-Lo Mastercard Credit Card

The application process is simple and can be completed with a few well defined steps.

- Visit the official PNB website or a nearby branch to start your application.

- Fill out the form with your personal, financial, and updated contact information.

- Submit the required documents and wait for the bank’s credit review.

- After approval, track delivery and activate the card according to the instructions provided.

Following this step by step guide makes the application safer and reduces delays.

Applicable fees of the PNB Ze-Lo Mastercard Credit Card

Cartão de Crédito cartão de crédito PNB Ze-Lo Mastercard stands out for clear fees, helping you predict costs confidently.

Understanding charges prevents surprises on your statement and helps decide when to use, finance, or choose cheaper alternatives.

Annual fee

The Ze-Lo annual fee is ₱0 forever, so you keep the card active without recurring yearly costs.

This is great for beginners, backup cards, and anyone wanting practicality without paying just to hold a card.

With Cartão de Crédito cartão de crédito PNB Ze-Lo Mastercard, the waiver is permanent, reinforcing everyday predictability.

Even with no annual fee, other charges may apply depending on usage, so it is important to know the rules.

Late payment fee

PNB’s general rule indicates a late fee of up to ₱1,000 or the minimum unpaid amount, whichever is lower.

For Ze-Lo, the late payment fee does not apply, reducing penalties when an unexpected delay happens.

Even so, interest may apply to unpaid balances, so paying the full amount by the due date remains ideal.

Use reminders and organize your due date to keep your financial routine light, predictable, and stress free.

Overlimit fee

PNB’s general rule indicates an overlimit fee of ₱500 when the total due exceeds the approved credit limit.

For Ze-Lo, this fee does not apply, avoiding extra charges for exceeding the purchase limit.

Even without the fee, going over the limit can cause declines and disrupt important daily purchases.

Monitor available credit and leave room for installments and subscriptions, especially near statement closing.

Monthly interest rate

The Ze-Lo monthly interest rate, called finance charge, is 2.5 percent per month on unpaid balances.

It applies when you do not pay the full statement amount, allowing debt to grow quickly.

If you pay everything by the due date, you usually avoid this cost and enjoy calmer usage.

When financing is necessary, calculate totals and set a realistic plan that fits your budget.

Cash advance

For cash advances, PNB charges ₱200 per withdrawal in peso accounts, plus charges on the withdrawn balance.

Since this type of use can become expensive quickly, it is best reserved for emergencies and short periods.

Before withdrawing, compare other options because total costs can vary significantly by situation.

If possible, keep an emergency fund to reduce reliance on card cash advances.

Card replacement

For replacement due to loss, theft, or damage, the indicated replacement fee is ₱400 per issued card.

As soon as you notice the issue, block the card to avoid unauthorized transactions and further inconvenience.

With Cartão de Crédito cartão de crédito PNB Ze-Lo Mastercard, this fee exists, but replacement restores access to credit.

Keep your contact details updated to receive the new card faster and with greater security.

Conclusion

Choosing a card becomes easier when you understand what truly affects your wallet, such as interest, fees, and everyday usage conditions.

PNB Ze-Lo stands out by reducing common charges, offering more predictability for those who want to spend calmly and plan better.

Still, the key is conscious use, paying statements on time, and enjoying benefits without turning purchases into debt.

Liked it? Then also check out the UnionBank U Visa Platinum Credit Card in the article below!

UnionBank U Visa Platinum Credit Card

Check out the article and learn about the UnionBank U Visa Platinum Credit Card.